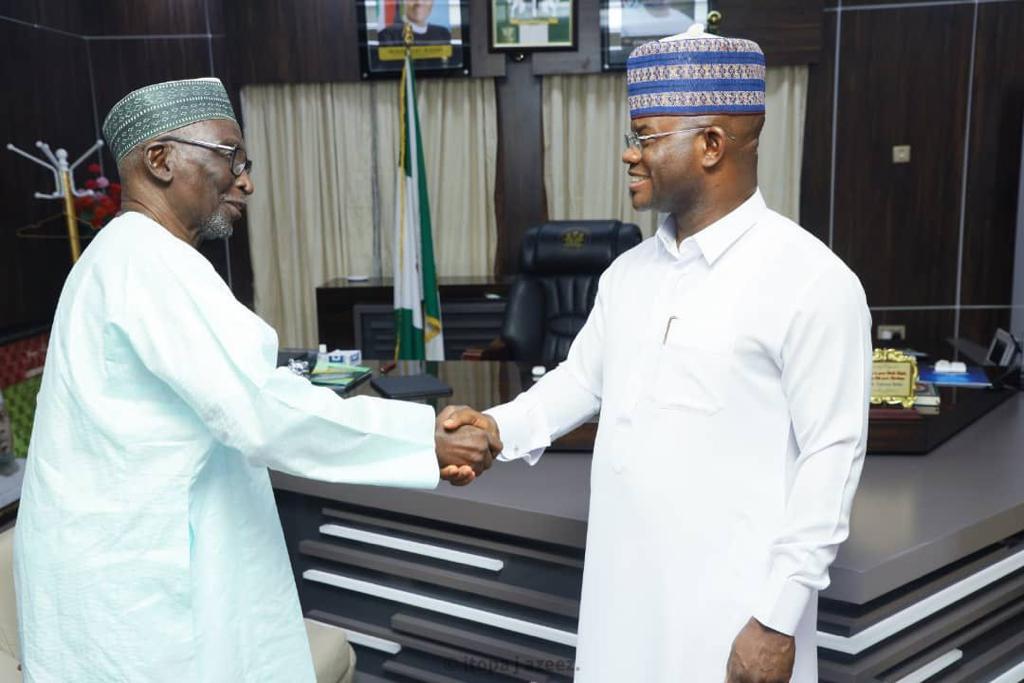

Governor of Kogi State, Mr Yahaya Bello, has appeared before the state House of Assembly to present the 2022 budget proposal.

Gatekeepers News reports that Governor Bello presented the proposal, ‘’Budget of accelerated result 2022,” to the assembly on Thursday.

He assured the Kogi people that the government would be transparent with the 2022 budget to ensure accountability.

“Accountability and open governance start with a timely and transparent showcase of Government income, proposed expenditure plan and levels of performance,” he said.

Bello noted that the total estimated recurrent revenue of the budget was N96.7 billion consisting of N23.2 billion, which will be realised from internal sources, while N49.5 billion comes from the federation account.

Bello said a total of N19.6 billion revenue is expected from Value-Added Tax (VAT) as N100 million from excess crude and N1billion from exchange difference.

Continuing, Bello said, “Recurrent revenue for the year 2020 stands at N96,792,006,352. Out of the above figure, the estimated personnel cost for the period is N45,119,725,532, whereas N45,031,565,719 is Overhead Costs, thereby giving N90,151,291,251 as a total recurrent expenditure for the year 2022.

“From the foregoing, we have a total estimated Transfer Surplus of N6,640,715,100 as Capital Development Fund. The estimated Capital Receipt is N49,104,066,562 comprising Capital receipts analysis by economic, Aids and Grants. However, if the Transfer Surplus of N6,640,715,100 is added to this amount, we shall have N55,744,781,662 as a fund available for capital development projects”.

He said the critical target for the 2022 fiscal year is to ensure the actualisation of the government’s development priorities as articulated in the State Development Plan and respective Sector Implementation Plans (SIPS).

Other targets of the 2022 budget, as itemised by Governor Bello, includes maintaining a favourable proportion of Capital to Recurrent expenditure, completing all ongoing projects and adding new projects in areas of critical need, expanding revenue generation to reduce over-dependence on federal allocation, maintaining a sustainable debt position thereby reducing the state domestic debt profile, providing a conducive environment for investors and donor agencies to operate in the state, and enhance greater transparency, accountability and proper public expenditure management.