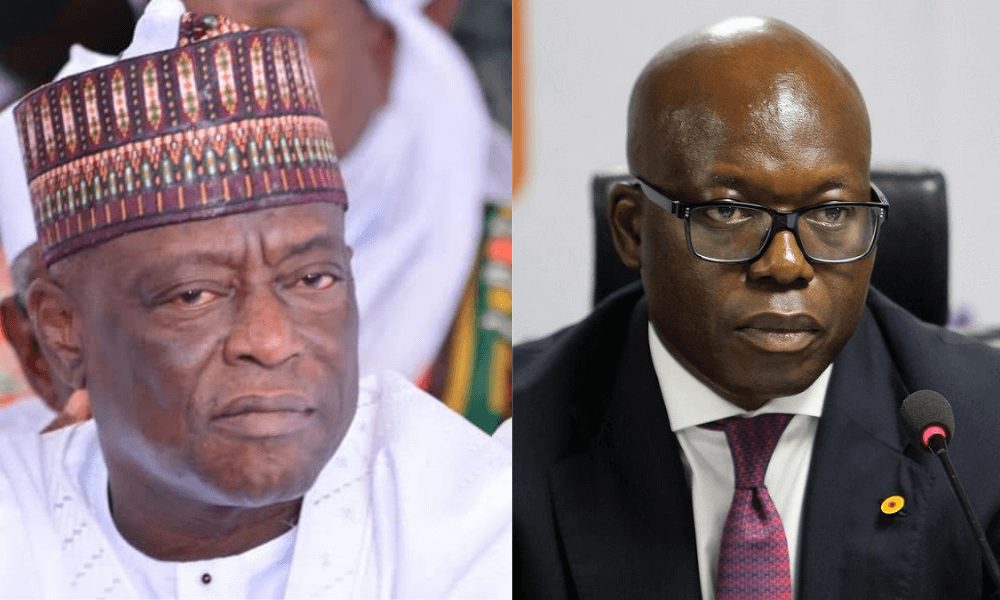

Central Bank of Nigeria (CBN)’s Governor, Godwin Emefiele has launched a N500 million Tertiary Institutions Entrepreneurship Scheme (TIES).

Gatekeepers News reports that the scheme was launched on Thursday in Abuja, the nation’s capital, with the aim to create an enabling business environment that supports innovation.

Emefiele said the scheme would also enable the youth to unleash their entrepreneurial potential, by redirecting their focus from seeking white-collar jobs to embracing a culture of entrepreneurship.

The initiative is expected to boost entrepreneurship in higher institutions of learning.

Emefiele urged the government at all levels to evolve policy measures to support entrepreneurial development among the youth in the country. He said this was particularly crucial given that about 600,000 students graduate yearly from Nigerian tertiary institutions without commensurate employment opportunities in both the public and private sectors.

According to Emefiele, the essence of the intervention was to create a paradigm shift from the obsession for white-collar jobs among graduates and promote entrepreneurship.

The CBN Governor explained that the intervention consisted of three main components, including term loan, equity investments, and development grants.

Emefiele said the scheme would make it easy for youths to access credit and create jobs for themselves and others. He warned that the finance to be provided was not a grant but a loan, which should be used for the intended purposes.

Essentially, he said TIES was conceived as part of measures to promote entrepreneurship development among the graduate and undergraduate youths of Nigerian polytechnics and universities, with the release of the implementation guidelines and the opening of a portal for submission of applications in October 2021.

Emefiele said the official launch of the TIES and subsequent inauguration of the BoE for the scheme’s development component was a testimony to the important role the youth play in building new blocks for economic growth, particularly as national growth was highly dependent on strong and competitive businesses.

He said bridging their financing gaps and enhancing access to low-cost credit to drive the development of business was a task that could only be addressed by an innovative financing model that correlates with the complexity and dynamics of these small businesses.

Emefiele noted that the scheme was designed to address three verticals of the segment namely, term loan component, which provides direct credit opportunities to graduates of Nigerian polytechnics and universities of not more than seven years post-graduation.

He said an applicant, if successful, should be eligible for a maximum of N5 million for an individual, sole-proprietorship or small company; and a maximum of N25 million for a partnership or company.

The tenure of the facility is a maximum of five years, with a one-year moratorium, and at an interest of five per cent per annum, which shall revert to nine per cent from March 2022.

The pilot phase of the scheme is presently being implemented through the Bank of Industry (BOI) with the development of an application portal and the processing of submitted applications.

The equity investment component is designed to support start-ups, existing businesses requiring expansion, and ailing businesses seeking resuscitation, and shall be implemented under the bank’s AGSMEIS equity window.

The investment limit shall be subject to the limit prescribed by the AGSMEIS guidelines and the investment period, not more than 10 years.

Emefiele also noted that the development grant component was aimed at raising awareness and visibility of entrepreneurship among undergraduates of Nigerian tertiary institutions.

He explained that here, polytechnics and universities in the country shall compete in a national biennial entrepreneurship competition where undergraduates are presented by the tertiary institutions to pitch innovative entrepreneurial or technological ideas with transformational potential.

According to him, three top institutions at the regional levels shall proceed to the national level, where the top five shall be awarded grants ranging between N120 million and N250 million.

He insisted that the grant awards should be used by the tertiary institutions solely for the development of award-willing ideas.