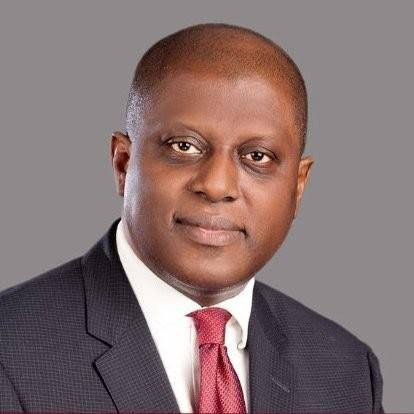

Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso has said the financial regulator will pull back from direct development finance interventions.

Gatekeepers News reports that the CBN Governor, in a statement on Thursday, said the apex bank needs to return to its core functions of monetary policies and advisory roles to support economic growth.

Cardoso said under previous leadership, the CBN had included fiscal intervention in its functions.

This, the apex bank governor said, blurred the lines between monetary and fiscal environments.

Cardoso said, “In refocusing the CBN to its core mandate, there is a need to pull the CBN back from direct development finance interventions into more limited advisory roles that support economic growth.”

According to him, the CBN’s advisory roles could include acting as a catalyst to promote specialised institutions and financial products that support emerging sectors of the economy.

Cardoso said the new regulatory frameworks will be facilitated to unlock dormant capital in land and property holdings, as well as increase access to consumer credit and expand financial inclusion to the masses.

He noted that part of the activities of the CBN will include increasing private sector investment in housing, textiles and clothing, food supply chain, healthcare, and educational supplies by de-risking instrumentation.

Cardoso said, “These verticals have huge demand patterns, with the potential for high local inputs and value retention, and can be the basis for rapid industrialisation.”

He noted that CBN will use its convening power to foster partnerships between key multilateral and international stakeholders in government and private sector initiatives.

According to him, the problems confronting the Central Bank are large and complex and can not be solved by the new management overnight.

Cardoso said, “It must be emphasised that CBN does not have a magic wand that can be waved at the current economic challenges.”

He added that “with focused leadership and sustained reforms, it is expected that over time, the country will see gains open economic spaces, attract new investments, create employment, and give our hardworking and talented compatriots opportunity for a more prosperous future.”

Cardoso, while highlighting some of the challenges faced by the apex bank, listed failure in corporate governance, diminished institutional autonomy and the need to refocus CBN back to core functions.

He added that the CBN is facing the problem of discontinuing unorthodox monetary policies and foreign currency management.

Cardoso stated that the financial regulator is looking into the backlog of forex demand, examining creative financing options for clearing the short to medium-term backlog and ensuring inflation and price stability.

He added that the CBN is considering control options to enforce statutory limits in the use of ways and means for financing public sector deficit.