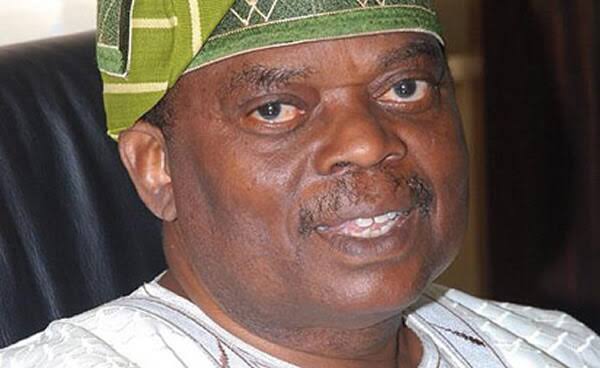

Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso has said the apex bank will stop its ways and means advances to the Federal Government.

Gatekeepers News reports that Ways and Means is a loan facility through which the CBN provides short-term financing to cover the government’s budget shortfalls.

Speaking on Friday when he appeared before the senate committee on banking, insurance and other finance institutions, in Abuja, Cardoso said the apex bank will no longer be a part of Ways and Means agreement with the federal government until all outstanding debts are refunded.

The decision, according to him, complies with Section (38) of the CBN Act (2007).

“I am pleased to note the fiscal authorities efforts in discontinuing ways and means advances,” Cardoso said.

“This is also in compliance with section (38) of the CBN Act (2007). The bank is no longer at liberty to grant further ways and means advances to the federal government until the outstanding balance as of December 31, 2023, is fully settled.

“The bank must strictly adhere to the law limiting advances under ways and means to 5 percent of the previous year’s revenue.”

According to Cardoso, the payment of the outstanding balance of the Ways and Means will control inflation in the country.

On December 30, 2023, the National Assembly approved President Bola Tinubu’s request for the securitisation of outstanding N7.3 trillion Ways and Means debt balance.

Prior, on May 23, 2023, the Senate approved the sum of N22.7 trillion Ways and Means loan, thereby securitising the debt. Tinubu’s predecessor — former President Muhammadu Buhari — had made the securitisation request on December 28, 2022.