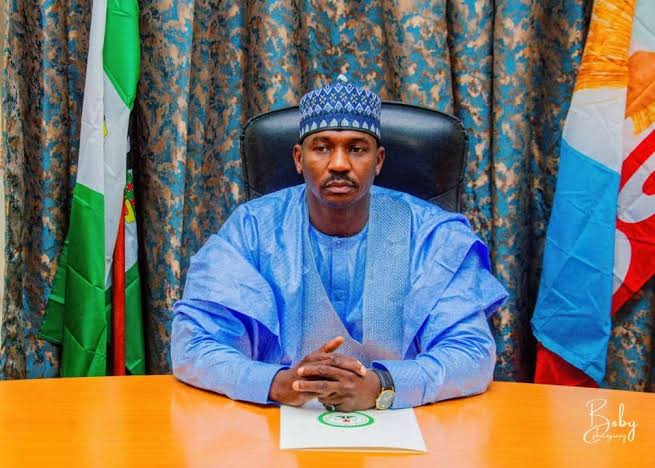

Joseph Tegbe, the Director-General of the Nigeria-China Strategic Partnership (NCSP), has announced that Nigeria is on the verge of signing a significant agreement with China to facilitate the direct conversion of the Nigerian naira to the Chinese yuan using the ‘Digital RMB.’

Gatekeepers News reports that this digital currency, known as the renminbi (RMB), is issued by the People’s Bank of China and represents a central bank digital currency.

During a recent masterclass on digital asset market strategies held in Lagos, Tegbe emphasized that this deal aims to reduce Nigeria’s reliance on the United States dollar.

He characterised the forthcoming agreement as a pivotal move toward a mutually beneficial development partnership between Nigeria and China, marking a shift from a purely trade-focused relationship.

In terms of investment, Tegbe highlighted that, over the past five months, Nigeria has attracted over $30 billion in investment commitments and received 300 expressions of interest from various Chinese companies. He also underscored the significance of utilizing Chinese technology, particularly in the digital asset sector, and stressed the importance of knowledge transfer. The NCSP is dedicated to advancing the globalization of Nigeria’s capital market through this partnership.

Furthermore, Tegbe outlined the key objectives of the partnership, which include driving infrastructure development, promoting increased Chinese investment, strengthening trade and economic collaborations, enhancing transparency, and fostering cultural exchange between the two nations.

In related news, Babajide Sanwo-Olu, the governor of Lagos State, announced plans to develop a securitization policy aimed at monetizing idle assets and raising green bonds to finance infrastructure projects. Represented by Abayomi Oluyomi, the commissioner for finance, Sanwo-Olu stated that Lagos is set to become the first sub-national entity in Nigeria to implement such a policy.

In his remarks, Nicholas Okoye, convener of the masterclass and a global investment advisor, said the digital transformation ushered in by the fourth industrial revolution has impacted all sectors and will open new frontiers of wealth for investors, institutions, nations, and sub-nationals.

“The most strategic ecosystem of this digital transformation has got to be ‘Digital Asset Markets’, which includes investment in cryptocurrencies as well as the tokenisation (digitisation) of traditional asset classes,” Okoye said.

“The proposed full adoption of ‘Digital Asset Markets’ in Nigeria’s capital markets and subsequently across Africa is going to be a game changer for wealth creation and economic growth sustainability.

“In addition, it will completely redefine the future of African finance, investment and capital market industries.”

Okoye said the digital assets present a unique opportunity for Africans to build wealth regardless of location or profession, providing for the first time, an accurate reflection of Nigeria and Africa’s true wealth position.