President Bola Ahmed Tinubu has established National Credit Guarantee Company (NCGC), with an initial capital of N100 billion.

Gatekeepers News reports that he also approved the constitution of the

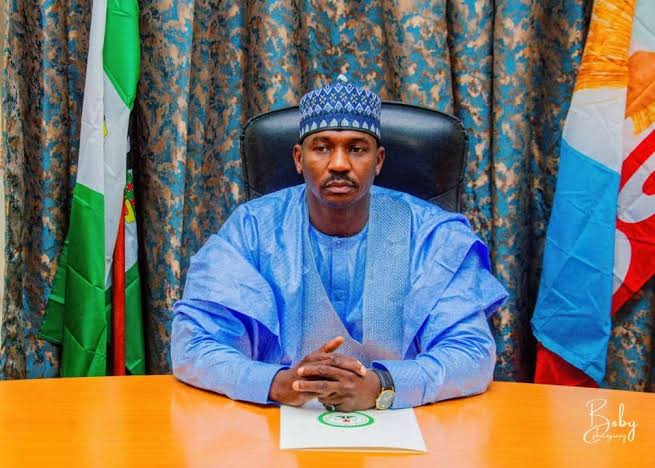

NCGC board and appointed Yakubu Dogara, former speaker of the House of Representatives, as chairman.

In a statement on Thursday, the presidency described the company as a transformative institution designed to de-risk lending and boost access to finance for micro, small, and medium enterprises (MSMEs).

The NCGC is also expected to serve small corporates, manufacturers, consumers, and large enterprises across Nigeria.

The presidency added, “This landmark move is in keeping with His Excellency’s 2025 New Year Message promising to unlock credit and fuel sustainable economic growth for all.”

“The President highlighted that the initiative will strengthen confidence in the financial system, expand credit access, and support under-served groups such as women and youth while driving growth, reindustrialization, job creation and better living standards for Nigerians.”

President Tinubu also appointed Bonaventure Okhaimo as Managing Director and CEO of the NCGC.

Other key appointments include

Others appointed by the president include Tinoula Aigwedo as executive director of strategy and operations; Ezekiel Oseni as executive director of risk management; and Yeside Kazeem,an actuarial expert as an independent non-executive director.

The presidency noted that all the appointments would take effect immediately.

Additionally, representatives from major stakeholder institutions were named as Non-Executive Board Members. These include Aminu Sadiq Umar (Nigeria Sovereign Investment Authority), Dr. Olasupo Olusi (Bank of Industry), Uzoma Nwagba (Nigeria Consumer Credit Corporation), and Oluwakemi Owonubi (Ministry of Finance Incorporated).

According to the presidency, NCGC is scheduled to begin full operations in July 2025. Its initial capital of ₦100 billion comes from a consortium of the Ministry of Finance Incorporated (MOFI), the Nigeria Sovereign Investment Authority (NSIA), the Bank of Industry (BOI), and the Nigerian Consumer Credit Corporation (CrediCorp).

It noted that the World Bank Group is also providing technical assistance to

NCGC, bringing its wealth of experience in other jurisdictions.