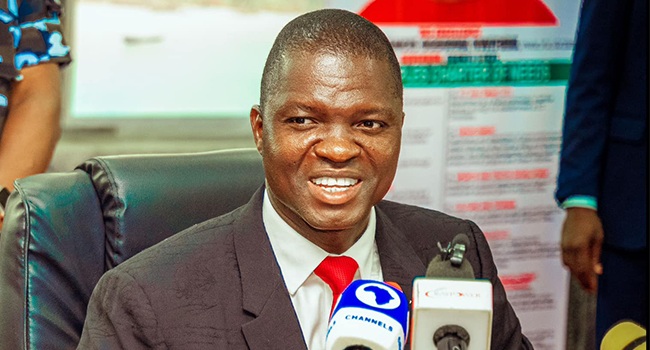

A magistrate court in Federal Capital Territory (FCT) has summoned Dino Melaye, former senator representing Kogi West, over allegations of defaulting on his personal income tax obligations for 2023 and 2024.

Gatekeepers News reports that the summons, dated August 21, 2025, was signed by presiding magistrate Chiemena Nonye-okoronkwo and directed Melaye to appear before the court in Wuse Zone II on September 5.

According to Federal Capital Territory Internal Revenue Service (FCT-IRS), Melaye also has records of underpayment in previous years.

Documents cited by the agency show he paid N85,000.08 in 2019, N100,000.08 in 2020, N120,000 in 2021, and N1 million in 2022, despite declaring significantly higher incomes. For example, in 2022, the former lawmaker reportedly declared earnings of over N6.5 million.

The tax authority explained that an administrative assessment for 2023 and 2024 was issued on May 23, 2025, but after Melaye failed to respond within 30 days, a Best of Judgment (BOJ) assessment was raised on June 23. His liabilities were then assessed at N234.9 million for 2023 and N274.7 million for 2024.

The notice stated, “Despite reminders and ample time provided, your non-compliance with Section 41 of the Act constitutes a breach of your obligations. Consequently, the Federal Capital Territory Internal Revenue Service (FCT-IRS) has, in accordance with Section 54(3) of the Personal Income Tax Act, proceeded to raise a Best of Judgment Assessment in respect of your tax liabilities for the years under review.”

“Accordingly, your tax liability has been assessed in the sum of N234,896,000.00 and N274,712,000.00 for the period of 2023 and 2024, respectively. The computation and assessment are attached for your action.”

“Please note that the Service has also identified income under declaration and under payment for the 2020, 2021 and 2022 years of assessment, during which payment of N1,000,000.00, N120,000.00 and N100,000.00 were made respectively. Notices of additional will be issued upon the conclusion of our review.”

“You are, hereby, informed that you have the right to object to this assessment within thirty (30) days from the date of receipt of this notice. Any objection must clearly state the grounds of your objection and be substantiated with relevant supporting documents.”

“Failure to make payment or file objection within the stipulated period will result in the assessment being deemed final and conclusive, and recovery proceedings will be initiated without further notice.”