The federal government has announced that Nigeria’s sweeping tax reform laws have now been officially published in the government gazette, marking a major milestone in overhauling the nation’s fiscal framework.

Gatekeepers News reports that signed into law on June 26, 2025, the reforms introduce a new foundation for taxation, administration, and revenue collection in Africa’s largest economy.

The four legislations are:

• Nigeria Tax Act (NTA), 2025

• Nigeria Tax Administration Act (NTAA), 2025

• Nigeria Revenue Service (Establishment) Act (NRSEA), 2025

• Joint Revenue Board (Establishment) Act (JRBEA), 2025

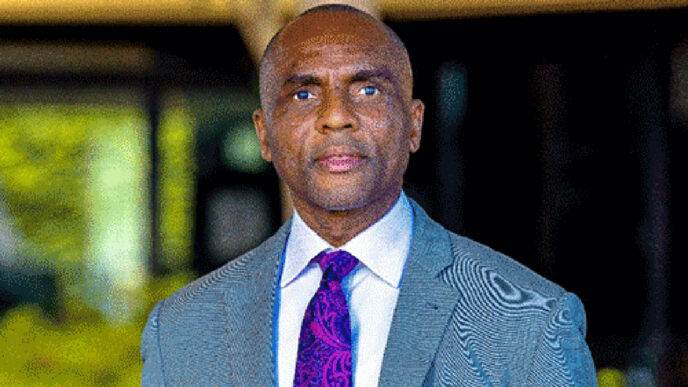

Confirming the publication on his official X handle, Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, said the laws are designed to modernise Nigeria’s tax system, improve compliance, and foster a more business-friendly environment.

Key Highlights of the Reforms

• Relief for Small Businesses: Companies earning below N100 million in annual turnover and with assets under N250 million will be fully exempt from corporate tax.

• Corporate Tax Adjustment: The rate for large firms could be cut from 30% to 25%, subject to presidential approval on the advice of the National Economic Council.

• Top-Up Tax Thresholds: Set at N50 billion in revenue for local firms and €750 million for multinationals.

• Incentives for Investors: Eligible projects in priority sectors will qualify for a 5% annual tax credit.

• Forex Relief for Businesses: Companies engaging in foreign currency transactions may now opt to pay taxes in naira at the official exchange rate.

Implementation Timeline

• NTA and NTAA: To commence on January 1, 2026.

• NRSEA and JRBEA: Effective immediately from June 26, 2025.

Oyedele explained that the staggered rollout is intended to give tax and revenue institutions sufficient time to prepare for full implementation in 2026.

“The NTA and NTAA will commence on 1st January 2026, while the NRSEA and JRBEA have a commencement date of 26 June 2025 to ensure readiness of the relevant institutions ahead of full implementation,” he said.

Expectations

The reforms are expected to simplify Nigeria’s tax landscape, ease compliance, attract investment into critical sectors, and strengthen the nation’s non-oil revenue base. Analysts say successful implementation will be crucial to achieving fiscal stability and inclusive growth.

Clarification on Fuel Surcharge

The Presidential Fiscal Policy and Tax Reforms Committee recently clarified that the proposed 5% fuel surcharge under the new laws will not apply to household energy products.

According to Oyedele, household kerosene, cooking gas (LPG), compressed natural gas (CNG), and renewable energy products are exempt, following concerns that the levy might worsen the cost-of-living crisis.