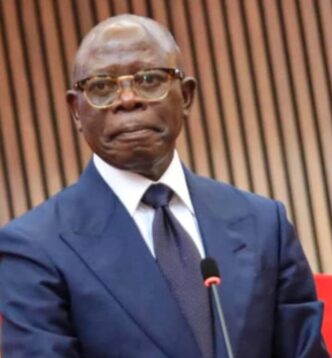

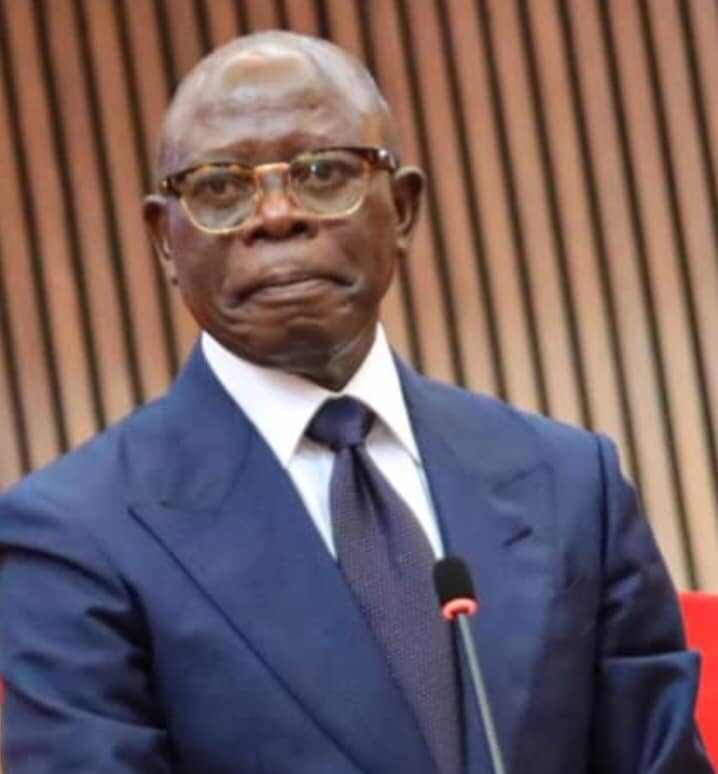

Senator Adams Oshiomhole has accused Nigerian banks of exploiting workers by keeping most of their staff on short-term contracts, denying them job security and basic entitlements.

Gatekeepers News reports that speaking on ARISE News on Friday, the Edo North senator described the practice as immoral and called for urgent reforms in the financial sector.

“It shocks me that as we speak, about 60 per cent or more of bank employees are contract staff,” Oshiomhole said.

“They dress as though they are bankers, yet when they are thrown out, they have no gratuity, no security. They are not direct employees of the banks. These practices must be stopped.”

He alleged that banks deliberately created employment agencies to recruit staff on their behalf, paying them lower wages while avoiding labour obligations. He likened the arrangement to modern exploitation, arguing it boosts corporate profits at the expense of workers’ rights.

His remarks echo long-standing concerns over the outsourcing of core banking roles, including tellers and customer service officers.

A 2023 report by the Chartered Institute of Bankers of Nigeria (CIBN) found that contract workers account for nearly 65 per cent of the industry’s workforce, typically earning less than half the salaries of permanent staff and excluded from pensions, health insurance, or housing benefits.

Labour unions argue the system fuels stress, unethical practices, and even fraud risks — concerns also raised by the Central Bank of Nigeria (CBN). While the Labour Act mandates “equal pay for equal work,” weak enforcement has allowed outsourcing firms to exploit loopholes with little oversight.

The National Union of Banks, Insurance and Financial Institutions Employees (NUBIFIE) has repeatedly demanded reforms to guarantee permanent employment status after two to three years of service. Similarly, the Nigeria Labour Congress (NLC) has petitioned parliament for tighter regulations, while the International Labour Organisation (ILO) has urged Nigeria to align with global decent work standards.

In 2022, unions warned of possible nationwide strikes if reforms were not implemented — a threat that underscores continuing tensions in the country’s financial sector.