With less than three months to the rollout of Nigeria’s new tax regime, the Federal Government has unveiled a sweeping package of fiscal and institutional reforms aimed at boosting non-oil revenue, improving transparency, and cutting leakages in public finance.

Gatekeepers News reports that the reforms — anchored on digital transformation, fiscal discipline, and institutional consolidation — are part of President Bola Tinubu’s broader strategy to strengthen the country’s revenue base and reduce dependence on oil.

A major highlight is the planned transition of the Federal Inland Revenue Service (FIRS) into the National Revenue Service (NRS) by January 2026. The new unified agency will assume revenue collection functions currently spread across the Nigerian Customs Service (NCS) and other bodies.

According to the Ministry of Finance, the reform drive seeks to raise Nigeria’s tax-to-GDP ratio from the current 10 per cent to 18 per cent within three years — surpassing the African average of 16 per cent and reducing the country’s reliance on debt.

“By ensuring that every kobo due to the government is digitally tracked and fully reconciled, we are safeguarding national resources,” said Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

“More importantly, we are creating the fiscal room to invest in education, health, and infrastructure — investments that will directly improve the lives of Nigerians and secure a prosperous future for our country.”

Technology and Transparency at the Core

Central to the reform package is automation — the full digitisation of public revenue inflows to curb human interference and seal long-standing leakages.

The Ministry of Finance recently launched the Federal Treasury Receipt (FTR), a system providing a single, digitally verifiable proof for all payments made into federal accounts. It is being deployed alongside the Central Billing System (CBS), which standardises pricing and billing for government services.

Both initiatives are key components of the Revenue Optimisation and Assurance Project (REV-OP) — a centralised digital platform designed to monitor, track, and reconcile government revenues in real time.

Edun described REV-OP as a “transformational initiative that will integrate all revenue-generating agencies and create an unbroken chain of transparency from collection to remittance.”

The ministry said the platform, built on three pillars — transparency, efficiency, and digital transformation — allows real-time monitoring of agency performance by sector and region, improving fiscal planning and enforcement.

FIRS, Customs and Other Agencies Undergo Overhaul

The FIRS, which collected ₦21.6 trillion in 2024 — surpassing its ₦19.4 trillion target — has introduced structural and digital reforms to align with the federal optimisation agenda.

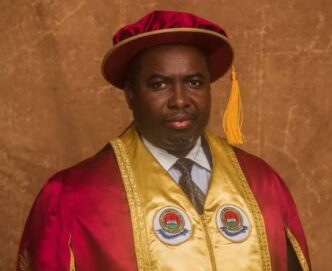

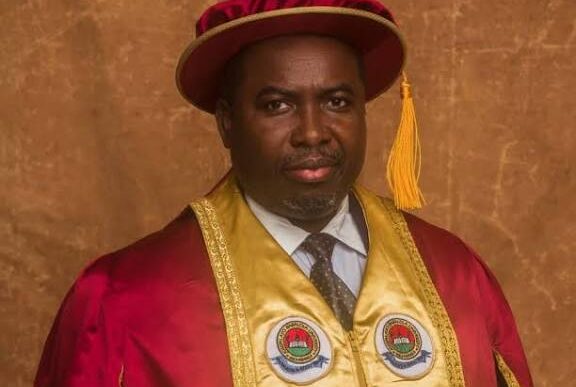

Chairman of the FIRS, Dr. Zacch Adedeji, said the agency’s new taxpayer classification system — grouping businesses by size — was designed to “replace bureaucracy with efficiency, promote voluntary compliance and rebuild public trust in the tax system.”

FIRS has also expanded its TaxPro Max digital platform, enabling online registration, tax filing, and payment. It now uses artificial intelligence to analyse financial data across sectors, uncovering underreported income in industries such as construction, maritime, and hospitality.

The Nigeria Customs Service (NCS) is also deploying an end-to-end e-Customs platform to automate cargo processing, reduce corruption, and harmonise trade documentation with the Nigerian Ports Authority (NPA) and Central Bank of Nigeria (CBN).

“Our goal is to build a transparent, technology-driven Customs system that leaves no room for manipulation or discretion,” said Comptroller-General of Customs, Adewale Adeniyi.

Cutting Cost of Collection and Leakages

One key target of the reform is the high cost of revenue collection, which reached ₦924.7 billion last year. Under the new framework, major revenue agencies including the FIRS, NCS and Nigerian Upstream Petroleum Regulatory Commission (NUPRC) have been directed to reduce or eliminate such deductions and remit gross revenues directly to the treasury.

Officials say the policy could free up significant funds for infrastructure and development spending.

Analysts have long argued that Nigeria’s fiscal challenge lies not in insufficient earnings but in the inefficiency and opacity of its revenue system. The new reforms, they say, represent the government’s strongest attempt yet to fix that structural flaw.

Meanwhile, the Ministry of Finance is also tightening oversight of non-tax revenues, including surpluses and service charges collected by ministries, departments, and agencies (MDAs).

The ministry said the ongoing 30-day pilot of FTR and CBS across 10 federal agencies will guide a nationwide rollout expected later this year, paving the way for the full operational take-off of the National Revenue Service in January 2026.