Federal Government (FG) has reaffirmed that the implementation of Nigeria’s newly enacted tax reform laws will commence on January 1, 2026.

Gatekeepers News reports that the government dismissed calls for a delay despite controversies surrounding the gazetted versions of the legislation.

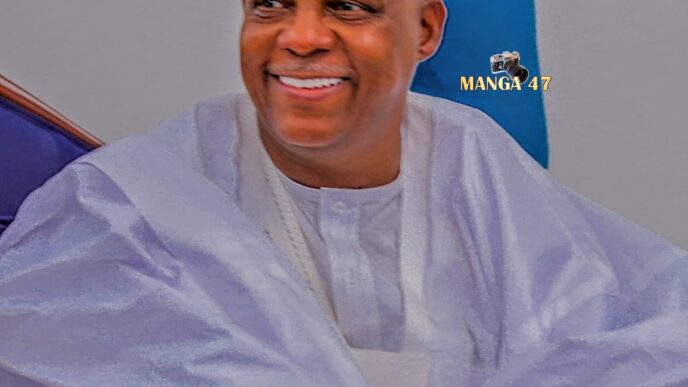

Chairman of Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, made the government’s position known after briefing President Bola Tinubu in Lagos on Friday.

He stressed that the reforms are aimed at easing the financial burden on Nigerians rather than boosting government revenue in the short term.

According to Oyedele, the rollout of the Nigeria Tax Act and the Tax Administration Act will proceed as scheduled, noting that the reforms are structured to deliver relief to workers and businesses across the country.

He explained that the majority of Nigerian workers would either pay reduced taxes or none at all under the new framework, while most small and medium-sized enterprises would be exempted from key taxes, including company income tax, value-added tax, and withholding tax. Larger corporations, he added, would also benefit from lower effective tax rates.

Oyedele said the reforms are designed to stimulate economic growth, promote inclusion, and encourage shared prosperity, describing the government as confident and prepared ahead of the January 2026 take-off date.

Addressing concerns about readiness, he disclosed that preparations have been ongoing for several months, including system upgrades, capacity building, and stakeholder engagement, even before the bills were signed into law.

He noted that two of the four tax reform laws—the Nigeria Revenue Service Establishment Act and the Joint Revenue Board Establishment Act—already took effect in June 2025 to allow institutions to adequately prepare for full implementation.

He acknowledged that tax reforms are an evolving process, adding that the government expects to refine the system over time rather than achieve perfection immediately.

On revenue expectations, Oyedele clarified that the reforms are not intended to generate quick income for the government. Instead, he said long-term revenue growth would come from an expanded tax base, improved compliance, and the removal of inefficient incentives as the economy grows.

The government’s insistence comes amid heightened controversy over allegations that the versions of the tax laws published in the Official Gazette differed from what was passed by the National Assembly.

Lawmakers had raised concerns about the inclusion of provisions not approved by parliament, prompting public debate and scrutiny.

In response, National Assembly has ordered a re-gazetting of the tax laws and the issuance of Certified True Copies to reflect the versions duly passed by both chambers.

Legislative leaders said the move was meant to safeguard accuracy and maintain the integrity of the lawmaking process, not to suggest any flaw in the authority of the legislature.

An ad hoc committee has also been constituted to probe the circumstances surrounding the passage, assent, and gazetting of the tax laws, as the government maintains that the implementation timeline remains unchanged.