Federal Government has made it clear that every Nigerian taxpayer, including employees and business owners, must submit their annual tax returns by March 31 each year, even if tax has already been deducted from salaries under PAYE (Pay-As-You-Earn) system.

Gatekeepers News reports that this requirement comes as part of ongoing efforts to improve tax compliance under the government’s new tax reforms.

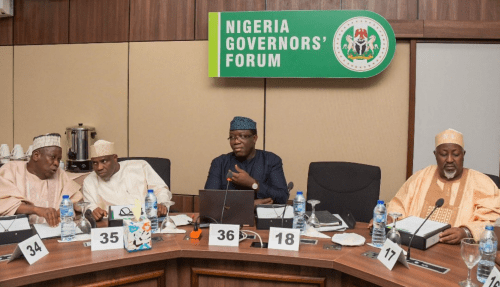

Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, reiterated this obligation during a webinar organised with the Joint Revenue Board (JRB) for human resource managers, payroll officers, chief financial officers, and tax managers.

The talk, which was later posted on his YouTube channel, highlighted that failure to meet the deadline remains a major problem across Nigeria, with less than 5 per cent of taxpayers meeting their filing obligations in many states.

Oyedele emphasised that employers must submit annual returns for their employees, including projections of salaries and tax liabilities for the year. At the same time, individual taxpayers must file their own self-assessment returns, regardless of whether their employer has deducted tax through PAYE.

He stressed that it is incorrect for employees to assume they are exempt from filing simply because their employer withheld tax.

The tax reforms, which took effect at the start of 2026 as part of broader changes to Nigeria’s fiscal system, also introduced new rules requiring businesses that benefit from tax incentives to declare those incentives when submitting tax returns or shortly afterward. Authorities say this move is aimed at enhancing transparency and widening the tax base.

Oyedele acknowledged that tax compliance has been weak and urged federal, state, and local revenue authorities to continue simplifying the filing process to make it easier for taxpayers, including low-income earners, to meet their obligations before the March 31 deadline.