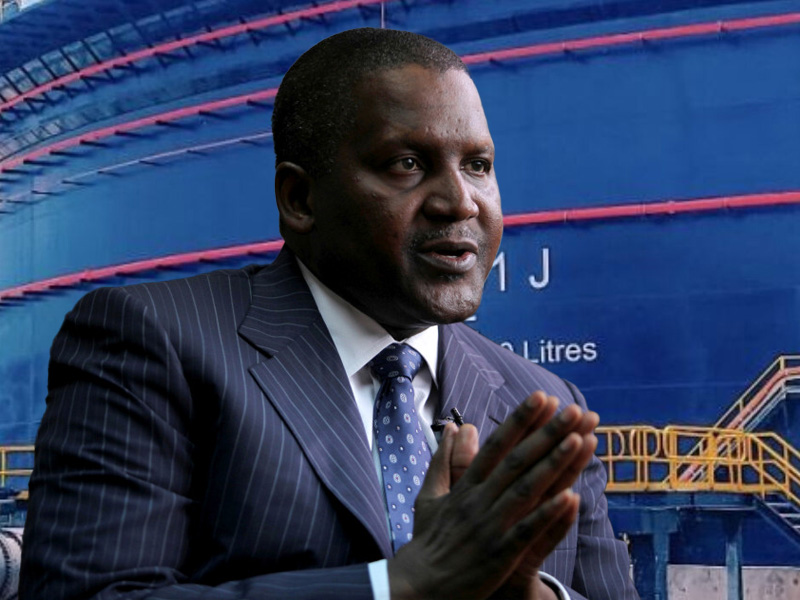

Aliko Dangote, Chairman of Dangote Group, has predicted that Nigeria’s currency could strengthen significantly this year, trading as high as N1,100 to one dollar if current economic reforms are sustained.

Gatekeepers News reports that he made this prediction on Tuesday while speaking at the federal government’s National Industrial Policy 2025 launch, where top government officials, industry leaders, and economic stakeholders gathered to discuss strategies for boosting local production and industrial growth.

The naira has shown notable improvement in recent weeks, gaining value across both the official and parallel markets. On Tuesday, it closed at N1,335.95 per dollar at the official window, while the black market rate stood at about N1,380 per dollar, reflecting renewed confidence driven by tighter forex policies, improved dollar inflows, and ongoing economic reforms by the federal government and the Central Bank of Nigeria.

Commenting on the trend, Dangote said Nigeria possesses vast potential to drive mass consumption, expand industrial output, and raise disposable incomes if the right policies are consistently implemented. He attributed the recent gains in the currency to government reforms and improved confidence among manufacturers.

“I mean today if you look at it, your excellency, ’ believe with the policies that you have implemented in government, people now have started seeing the result and manufacturers are very very happy,” Dangote said.

He added that further restrictions on excessive importation and stronger support for local manufacturing could push the naira even higher.

“Today, the dollar is N1,340. Mr. Vice-President, I can assure you with what I know, blocking all this importation and co, naira this year will be as low as N1,100 if we are lucky.”

“The only thing is for maybe the government to stop the naira from getting stronger so that they will keep collecting more naira.”

“But it’s a catch-22 situation where, now, if the naira gets stronger it means that everything will go down. Everything will go down because we are an import-based country which we shouldn’t be.”

“What you should be is to manufacture all the things that we need.”

Dangote also stressed the importance of boosting domestic production to reduce reliance on imports, stabilise the forex market, and support sustainable economic growth. He noted that increased local refining, industrial expansion, and improved supply chains would help conserve foreign exchange and strengthen the naira in the long term.

His optimism aligns with recent comments by Femi Otedola, Chairman of First HoldCo, who on February 12 expressed confidence that the naira could trade below N1,000 per dollar before the end of the year, particularly as domestic refining capacity expands and Nigeria reduces its dependence on imported petroleum products.

Economic analysts have similarly linked the recent appreciation of the naira to reforms in the foreign exchange market, increased oil production, improved remittance inflows, and the gradual recovery of investor confidence, noting that sustained policy consistency will be key to maintaining the positive momentum.