The Nigeria Revenue Service (NRS) has announced the continuation of the phased rollout of its invoicing and Electronic Fiscal System (EFS), also known as the Merchant Buyer Solution (MBS), to medium and emerging taxpayers.

Gatekeepers News reports that the agency said the move aligns with its mandate to strengthen tax administration, improve transparency, and promote voluntary compliance nationwide.

The e-invoicing platform officially went live for large taxpayers on August 1, 2025, following extensive consultations and stakeholder engagements. The initial implementation window was later extended to November 2025 to address operational and transitional challenges.

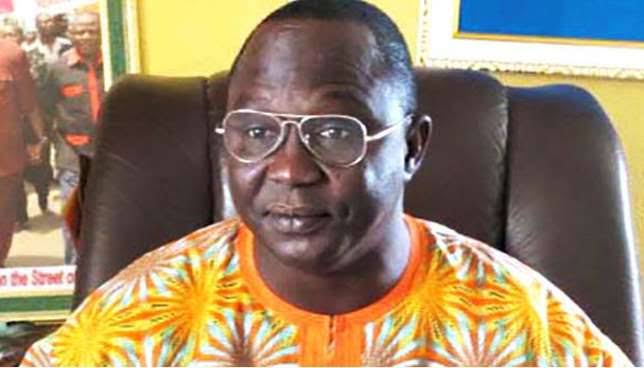

Providing an update in a notice issued on Monday, the NRS Chairman, Zacch Adedeji, said the service has recorded significant progress since the go-live date, with most large taxpayers already onboarded and many successfully transmitting invoice data to the MBS platform.

“Building on these achievements, and in line with Section 23 of the Nigeria Tax Administration Act (NTAA)… and Section 158 of the Nigeria Tax Act (NTA)… the NRS hereby notifies the general public of the continuation of the phased rollout of the e-invoicing solution to other taxpayer segments, namely medium taxpayers and emerging taxpayers,” the statement read.

He added that the rollout would follow five structured stages: stakeholder engagement, pilot rollout, go-live, post go-live review, and compliance enforcement.

Implementation Timeline

Large taxpayers

- Post go-live review: January – March 2026

- Compliance enforcement: April – June 2026

Medium taxpayers (annual turnover: ₦1bn – ₦5bn)

- Stakeholder engagement: January – March 2026

- Pilot rollout: April – June 2026

- Go-live: July 1, 2026

- Post go-live review: October – November 2026

- Compliance enforcement: January – March 2027

Emerging taxpayers (annual turnover below ₦1bn)

- Stakeholder engagement: January – March 2027

- Pilot rollout: April – June 2027

- Go-live: July 1, 2027

- Post go-live review: October – November 2027

- Compliance enforcement: January – March 2028

Adedeji urged taxpayers to identify their applicable category and comply with the timelines, while actively participating in engagement and onboarding activities.

He noted, however, that the timelines are indicative and subject to adjustment based on operational readiness and stakeholder feedback.

The NRS chairman reaffirmed the agency’s commitment to collaborating with all stakeholders to ensure a smooth transition and the successful adoption of the e-invoicing system.