International Monetary Fund (IMF) has removed Nigeria from its list of debtor countries following the complete settlement of its outstanding credit obligations.

Gatekeepers News reports that the update was shared in the latest IMF report, titled “Total IMF Credit Outstanding – Movement from May 01, 2025, to May 06, 2025,” which was published on the organisation’s website.

According to the report, Nigeria is no longer among the 91 developing and least developed countries that have outstanding credit obligations to the IMF.

Collectively, these countries owed a total of $117.8 billion as of May 6, 2025. Overall, the total IMF Credit Outstanding for all countries was reported at approximately $117.79 billion as of May 7, 2025, which includes both unpaid and outstanding principal from various current and expired arrangements with the IMF.

Over the past two years, Nigeria has shown a consistent trend of reducing its debt obligations to the IMF.

Data from StatiSense, a data intelligence firm, indicates that Nigeria’s debt to the IMF was $1.61 billion as of July 28, 2023. This figure decreased to $1.37 billion by January 5, 2024, further dropped to $933.03 million by July 10, 2024, and finally reached $472.06 million by January 8, 2025. By May 2025, Nigeria had successfully fully repaid its debt to the IMF.

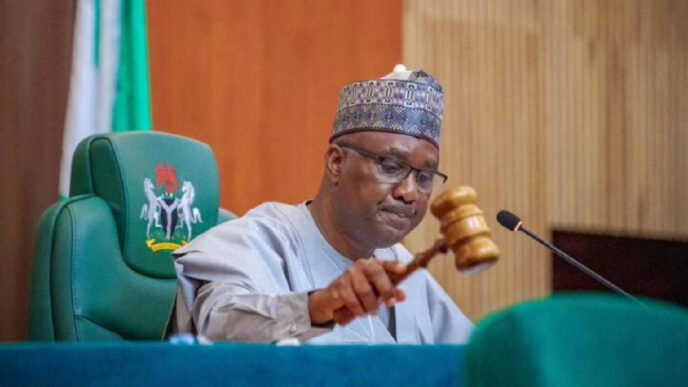

Reacting to the development, Senior Special Assistant to the President on Digital Engagement, Strategy, and New Media, O’tega Ogra, said the clearance of IMF debt signals a “strategic reset” in Nigeria’s financial management under President Bola Tinubu.

In a post via his official X (formerly Twitter) handle, Ogra noted that the development reflects the administration’s commitment to fiscal discipline, reform, and long-term sustainability.

“As Nigeria closes the chapter on these legacy debt obligations, we are better placed to strengthen our fiscal credibility and show the world—and ourselves—that Nigeria is serious about managing our economy with responsibility and vision,” he said.

Ogra clarified that Nigeria’s exit from the IMF debtor list does not mean it will no longer engage with the IMF or other international lenders. Rather, he said future engagements will be on a more strategic and partnership-oriented basis.

“This is definitely not a door slammed shut. Global partnerships, like the IMF, remain valuable allies, especially in a world defined by volatility and uncertainty. The difference now is that any future engagement will be proactive, not reactive, and based on partnership, not dependence,” Ogra added.

He further emphasized President Tinubu’s commitment to long-term structural reforms and responsible financial stewardship, stating, “Nigeria is rising with clarity, capacity, and credibility, and this is why you should take a #BetOnNigeria.”

In its recent public statements, the IMF has acknowledged Nigeria’s economic reforms, including the removal of fuel subsidies and foreign exchange unification, as bold steps that have helped stabilize the macroeconomic environment and set the stage for sustainable growth.