The Senate’s deliberation on major reforms to Nigeria’s financial laws took an unexpected turn on Thursday when Senator Natasha Akpoti-Uduaghan (Kogi Central) raised concerns about what she described as the “quiet exploitation” of young Nigerians earning income on global social media platforms.

Gatekeepers News reports that speaking during the second reading of the Banks and Other Financial Institutions Act (BOFIA) Amendment Bill, 2025 (SB 959), Natasha warned that Nigeria’s rapidly expanding digital workforce is being severely underpaid by tech giants, despite contributing significant traffic and engagement.

“Our youths are earning 50 cents for content that fetches $10 to $30 per 1,000 views in the U.S.,” she said. “This inequality must not be ignored as we reform our financial system.”

“I’m speaking for the content creators because, trust me, social media has become a very critical source of income for our youths,” she added.

The senator argued that such disparities distort Nigeria’s digital economy and have implications for financial inclusion. She urged lawmakers to factor the realities of the burgeoning online workforce into ongoing financial reforms. Natasha also called for stronger regulatory engagement with global tech companies, pushing for transparency, fairness and more equitable earning structures for Nigerians participating in the global content economy.

Her intervention broadened the conversation beyond banking risks to the economic future of millions of digital creators, insisting that any comprehensive reform of financial laws must address revenue fairness, transparency and clearer oversight of global tech platforms operating in Nigeria.

The main bill, sponsored by Senator Tokunbo Abiru (Lagos East), seeks to modernise BOFIA by granting the Central Bank of Nigeria (CBN) sweeping authority to classify large fintech companies as Systemically Important Institutions (SIIs), subjecting them to stricter oversight.

Abiru argued that fintechs and mobile-money operators have become critical infrastructure, processing transaction volumes rivaling those of traditional banks while holding vast amounts of customer data—often stored offshore.

“The law has not kept pace,” he said. “A dominant fintech can now pose as much risk as a bank.”

The bill proposes to empower the CBN to designate and supervise high-risk fintechs, establish a national registry for transparency and beneficial ownership, strengthen consumer protection, safeguard data sovereignty, and close regulatory gaps exposed by the CBN’s 2024 enforcement actions against certain fintech platforms.

Abiru dismissed calls for the creation of a separate fintech regulator, warning it would duplicate functions and create confusion. Globally, he said, the practice is to strengthen existing regulators rather than create new ones.

Although the bill has been referred to the Senate committee for further legislative work, Natasha’s intervention ensured that the debate now reflects one of Nigeria’s fastest-growing sectors: the digital economy and the millions who rely on it for livelihood.

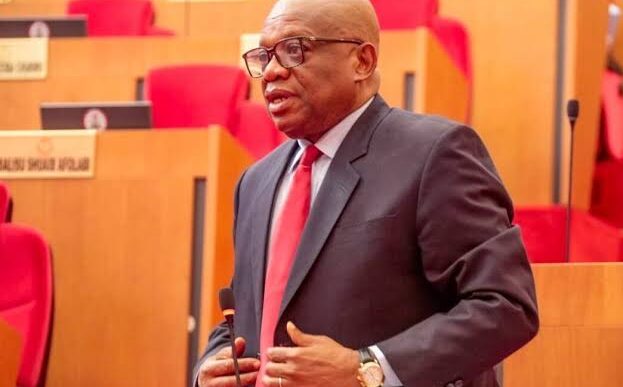

Contributing to the debate, former Nigeria Labour Congress (NLC) President Senator Adams Oshiomhole shared his experience of having his accounts hacked, saying the breach occurred through one of the fintech platforms. He added that the identities of key owners of many online operators remain unclear, making accountability difficult due to the absence of appropriate legal frameworks.

“I know the directors of our regular banks, but I can’t say the same of these fintech banks,” Oshiomhole said. “I don’t know the directors of MoniePoint, Opay and all others.”

He argued that proper regulation backed by law would ensure online financial institutions operate more transparently and in the best interest of Nigerians.