The Central Bank of Nigeria (CBN) has reaffirmed its commitment to transforming agricultural financing and repositioning the sector as a key driver of the country’s economic recovery.

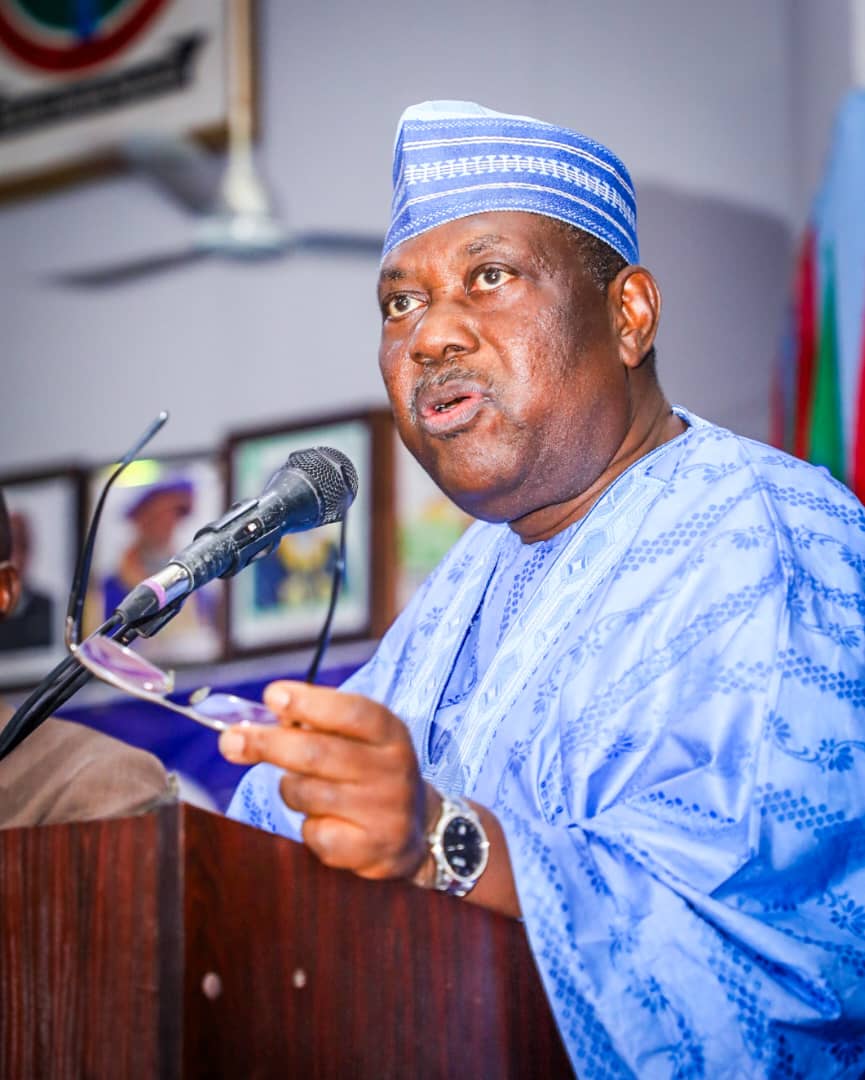

Gatekeepers News reports that although the bank will no longer engage directly in intervention financing, CBN governor Yemi Cardoso said the new approach marks “a new dawn for agricultural lending” and a clear departure from traditional systems that have left millions of farmers underserved despite their critical role in food production and rural livelihoods.

Speaking in Abuja yesterday at the inauguration of the newly reconstituted Board of the Agricultural Credit Guarantee Scheme Fund (ACGSF), Cardoso said: “Agriculture contributes more than a fifth of our GDP and employs nearly two-thirds of Nigeria’s workforce, yet it receives less than five per cent of total bank lending. This longstanding financing gap is no longer acceptable. The ACGSF must evolve to catalyse affordable credit and unlock the potential of our farmers.”

He recalled that the ACGSF, established in 1977 to de-risk agricultural lending by guaranteeing up to 75 percent of loan values, has supported countless farmers over the decades. However, he stressed that the scheme must adapt to a rapidly changing agricultural environment defined by longer value chains, climate-related challenges and new technologies.

Cardoso said the Fund is now better positioned to deliver on its mandate following the 2019 amendment that raised its share capital from ₦3 billion to ₦50 billion and expanded its scope. He also noted that the revised governance structure — which includes farmer representation — will help create a more inclusive and responsive scheme.

“The ACGSF must not simply process guarantees; it must drive an expansion of lending to agriculture on affordable terms,” he said. “Every hardworking farmer with a viable project should find in the scheme a partner that enables growth, not a barrier.”

The CBN governor identified smallholder farmers as the backbone of Nigeria’s agricultural system, but said they continue to face significant obstacles to accessing credit due to lack of collateral, insufficient records and perceived higher risk.

He added that expanding financial inclusion — particularly for women and youth who remain disproportionately excluded from agricultural credit and digital financial services — must be central to the board’s work. According to him, the scheme should collaborate with microfinance institutions, cooperatives and fintechs to design products tailored to underserved farmers, while leveraging group lending, mobile money and agent banking to improve access in remote communities.

Cardoso also tasked the board with strengthening monitoring and evaluation, urging the adoption of satellite imagery, digital dashboards and real-time analytics to track loan usage and measure productivity outcomes. “Every naira guaranteed must deliver real value on the farm and in the marketplace,” he said. “Robust oversight will ensure transparency, identify emerging risks and support better decision-making.”

He added that data-driven monitoring would be key for policy advocacy and refining the scheme to support national goals of food security and economic diversification.

Cardoso said the agricultural sector faces a moment of significant opportunity under the Federal Government’s Renewed Hope Agenda, which aims to build a resilient, modern and inclusive agricultural economy.