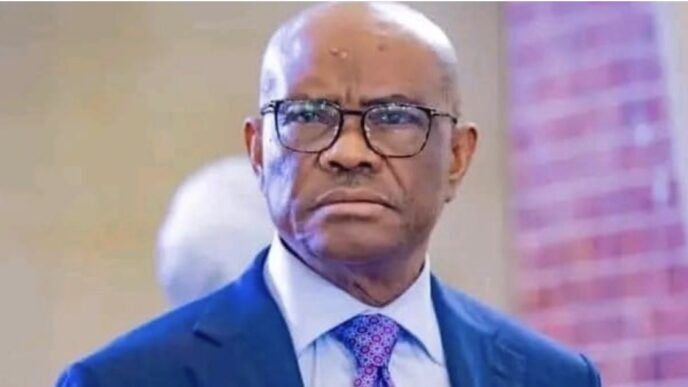

Taiwo Oyedele, Chairman of Presidential Fiscal Policy and Tax Reforms Committee, has revealed that commercial banks will be required to report accounts with a quarterly turnover of N25 million to the tax authority under Nigeria’s tax reform laws.

Gatekeepers News reports that Oyedele made this known on Friday while speaking at a media parley on the new tax laws, explaining that the reforms raised the reporting threshold from N10 million to N25 million.

The chairman said, “What this one has done is that it has raised the threshold for reporting your bank account. I think it was N10 million before, but it is now N25 million, which translates to N100 million.”

He recalled that Finance Act of January 13, 2020, introduced the requirement for individuals and businesses to link their tax identification number to bank accounts used for income purposes.

According to him, if you are using it for business or for any income, like a salary earner,” such accounts were already expected to be connected to a TIN, noting that some people had complied since then.

Oyedele said the policy of “putting TIN in your business account” was reviewed by his committee and retained in the new laws. He added that poor tax awareness has led to confusion among Nigerians.

The chairman said, “But because the level of tax awareness in Nigeria is so poor, people are finding out so many things for the first time. They just assume that the new tax law is introducing them. This one is actually not.”