The Federal Inland Revenue Service (FIRS) has clarified that the National Identification Number (NIN) will automatically serve as the Tax Identification Number (TIN) for individual Nigerians, while the Corporate Affairs Commission (CAC) registration number will function as the tax ID for registered businesses.

Gatekeepers News reports that the clarification was issued via the FIRS’ official X handle as part of its public awareness campaign on the new tax laws scheduled to take effect in January 2026.

According to the Service, the requirement for a Tax ID under the Nigeria Tax Administration Act (NTAA) is not new, noting that similar provisions have existed since the Finance Act of 2019 and have now been strengthened under the new law.

“The Nigeria Tax Administration Act (NTAA), set to take effect in January 2026, mandates the use of a Tax ID for specific transactions,” the FIRS said.

It added that the Tax ID system consolidates all previously issued tax identification numbers by the FIRS and State Internal Revenue Services into a single identifier.

“For individuals, your NIN automatically serves as your Tax ID, while for registered companies, your CAC RC number is used. You do not need a physical card, as the Tax ID is a unique number linked directly to your identity,” the Service stated.

The FIRS explained that the reform is aimed at simplifying taxpayer identification, eliminating duplication, curbing tax evasion and ensuring fairness by ensuring that all individuals with taxable income contribute appropriately.

The clarification comes amid public concerns over provisions in the new tax laws that require a Tax ID for certain transactions, including bank account ownership.

Meanwhile, the Nigerian Bar Association (NBA) has called for a comprehensive investigation into controversies surrounding the new tax laws, warning that the issues cast doubt on the integrity of Nigeria’s legislative process.

In a statement titled ‘Tax reform Acts: controversies cast doubts on the sanctity of Nigeria’s lawmaking processes’, the NBA expressed concern over alleged discrepancies between the version of the Nigeria Tax Administration Act passed by the National Assembly and the gazetted Act.

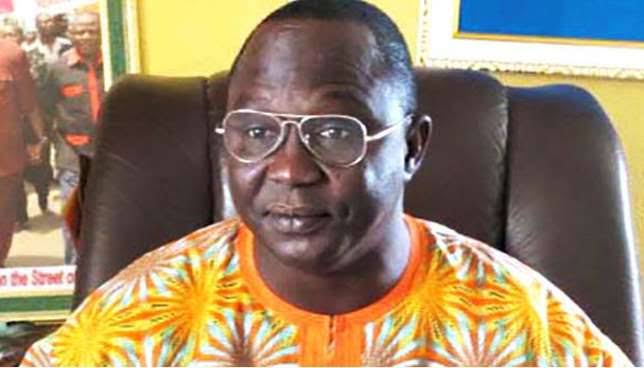

The statement, signed by the NBA President, Mazi Afam Osigwe, called for an open and transparent probe to clarify the circumstances surrounding the enactment of the laws and restore public confidence.

“Until these issues are fully examined and resolved, all plans for the implementation should be immediately suspended,” the NBA said.

The association warned that legal and policy uncertainty could unsettle the business environment, erode investor confidence and create unpredictability for individuals and institutions required to comply with the law.

“Such uncertainty is inimical to economic stability and should have no place in a system governed by the rule of law,” the statement added.

The NBA urged relevant authorities to act swiftly in resolving the controversy in the interest of constitutional order, economic stability and the preservation of the rule of law.