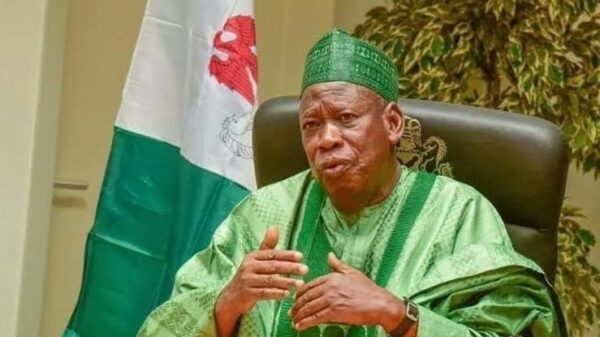

Central Bank of Nigeria (CBN) has ordered customers to tender indemnity to banks and Payment Service Providers for highly secured online funds transfers.

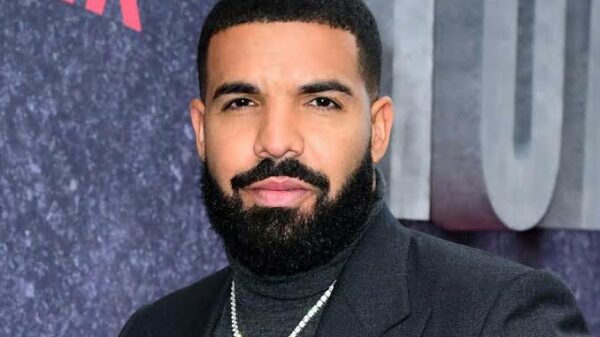

Gatekeepers News reports that this was contained in a circular signed by the Director, Payments System Management Department, Musa Jimoh, with the reference number: PSM/DIR/PUB/CIR/01/006, titled ‘Circular on the review of operations of the NIBSS Instant Payments System and other electronic payment options with similar features’, which was released on Thursday.

According to the circular, “Further to the circular on the above reference BSP/DIR/GEN/CIR/01/011 and dated August 13, 2014, banks are hereby required to comply with the following:

“Accept indemnity from customers for highly secured online funds transfer above N1m for individual and N10m for corporate, subject to a maximum of N25m (individual) and N250m (corporate).

“Provide customers with the option of electronic or paper indemnity based on the customer’s preference.

“Implement electronic indemnity with stricter controls requiring biometric verification of identity.

“Adhere to multiple factor authentication for highly secured online funds transfer.

“Inform and educate customers on the use of indemnity to increase transaction limits where possible.”

The apex bank also released another guideline titled ‘Guidelines for the registration & operation of Bank Neutral Cash Hubs in Nigeria’.

CBN stated in the guidelines that BNCHs were cash collection centers to be established by registered (licensed) processing companies or Deposit Money Banks based on business needs.

It added that the hubs would be located in areas with high volumes of commercial activities and cash transactions.

According to the CBN, the hubs would provide a platform for customers to make cash deposits and receive value irrespective of the bank with which their account is domiciled.

“This guideline aims to provide minimum standards and requirements for BNCH registration and operations for effective supervision,” the CBN said.

It added that the key objective of setting up the BNCH was to reduce the risks and costs borne by banks, merchants, and huge cash handlers in the course of cash management activities; deepen financial inclusion, and leverage shared services to enhance cash management efficiency.

The apex bank noted that the BNCH’s duties included receipt of naira denominated deposits on behalf of financial institutions from individuals and businesses with high volumes of cash; disbursement of naira-denominated withdrawals on behalf of financial institutions to individuals and businesses with high volumes of cash, and any other activities that might be permitted by the apex bank