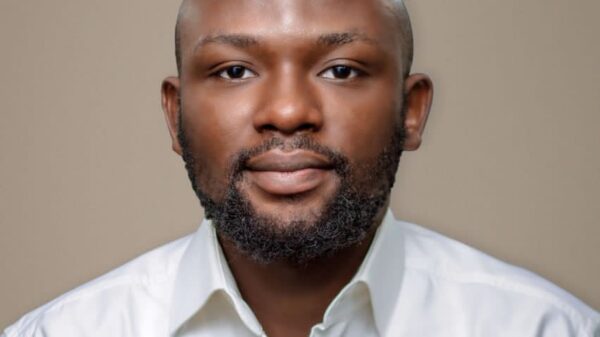

Former Minister of Finance, Kemi Adeosun and other economists, have called for international mechanisms for sovereign debt restructuring for Africa.

Gatekeepers News reports that the call was made during a panel discussion on sovereign debt crises at the Columbia Global Centers in Paris on Tuesday.

Adeosun alongside the world economists stated that the sovereign debt restructuring will assist the continent in achieving sustainable public finances.

The Nigerian minister from November 2015 to September 2018, said the long periods needed to carry out debt restructuring such as that in Zambia have their roots in lack of action before a default takes place.

Adeosun said this is due to failure to manage the pre-period, adding that countries in debt distress are often reluctant to admit it due to the need to cut social spending, especially in democratic countries.

According to her, “That means there is a tendency to kick the can down the road.”

She further urged Eurobond holders to initiate conversations with sovereigns ahead of a potential default.

Adeosun said, “If the sovereign is then able to keep servicing its debt, then there has been some loss of time, but when a restructuring is needed such conversations would ensure the process has a head start.”

On his part, a Nobel laureate in Economic Sciences, Joseph Stiglitz said the world has no framework for debt restructuring across sovereigns, adding that the result is too little for debt restructuring.

Stiglitz said the lack of international mechanisms for sovereign debt restructuring has hampered the prospects for Africa achieving sustainable public finances or being able to contribute to the clean energy transition.

He said, “The difficulty of coordination between diverse creditors including China and Western hedge funds who don’t trust anyone else makes debt restructuring more difficult.

“We have no framework for debt restructuring across sovereigns and the result is too little debt restructuring, too late.

“Private sector lenders have shown they are not good at assessing risk, as evidenced by the Great Financial Crisis starting in 2008.

“Nothing has been learned by the West since. There are incentives not to learn and not to respond to what is predictable.”

Former Minister of Economy in Argentina, Martin Guzman said he regrets the unsustainability of Africa’s sovereign debt.

Guzman said creditors and debtors have an incentive to delay restructuring in the hope that an institution such as the International Monetary Fund (IMF) will provide finance.

The Argentine former minister said, “When companies are bankrupt, there are insolvency frameworks that can regulate the process, often while being able to keep the company running.”

He noted that most of the debt restructurings taking place now won’t fix the underlying problems and the sovereigns concerned will probably require more restructuring later.