Securities and Exchange Commission (SEC) has formally approved the request of GlaxoSmithKline Consumer Nigeria Plc (GSK) to delist its shares from the Nigerian Exchange Limited (NGX).

Gatekeepers News reports that this approval is coming after the company announced the receipt of SEC’s formal approval of its scheme of arrangement, which will result in delisting from NGX.

The approval follows the Federal High Court Ordered Meeting which held on December 5, 2023, where the shareholders of GlaxoSmithKline Consumer Nigeria Plc approved the proposed Scheme of Arrangement.

GSK in a statement signed by its Company Secretary, Frederick Ichekwai, disclosed that the order of the Federal High Court sanctioning the Scheme of arrangement has also been obtained.

Ichekwai added that an application for the delisting of the Company’s shares from the NGX will be submitted imminently.

The order of the Court sanctioning the Scheme of Arrangement has also been obtained and an application for the delisting of the Company’s shares from the NGX will be submitted imminently”.

Although shareholders of GSK had approved the payment of N17.42 for every share held as part of the scheme of arrangements for the dissolution of the company, they expressed their discontent over the company’s decision to delist its shares.

The National Coordinator, Progressive Shareholders Association of Nigeria, Boniface Okezie, stated that owing to the state of the economy and spate of delistings, some of the shareholders are worried over their future investments in other companies.

Okezie said, “Although the decision was made by the shareholders last December, some of us were not happy and it was more like we did not have a choice here.

“There is so much corruption in this country and we might well be facing uncertain times over our investments in other companies. In fact, we are afraid that if these harsh times continue, most of these multinationals will leave.

“If they leave, then the economy crumbles. I must say this is not good for us as a giant of Africa that we are. It is unacceptable and this is why we need the present administration to do something quickly or else we are in for hard times as if it is not even here already.”

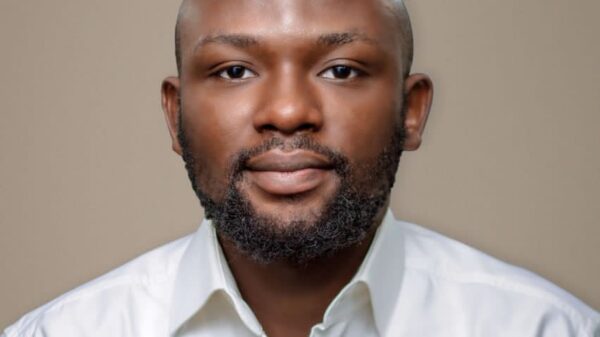

The Group Chief Executive Officer, NGX Group, Temi Popoola, while speaking at a forum recently, charged the government to work more on advocacy and policy-making to cut down the number of delistings in the stock market.

Popoola explained that Nigeria has been lucky to have listings of new firms on the course, stating that market capitalisation has increased by over 10 per cent in the past two years, which underscored NGX’s growing prominence as a preferred destination for corporate listings and capital raising.

He stated that the exchange has been making an effort to replace delistings faster than they occur.

Popoola, while highlighting the transformative impact of government interventions through policy changes, said more companies would be encouraged to list their shares on the stock exchange if there were good government policies.

GlaxoSmithKline had earlier announced on August 3, 2023, that it would be leaving Nigeria and shutting down its Nigerian subsidiary, GlaxoSmithKline Consumer Nigeria Plc, subject to approval from the regulatory authorities.