Olu Verheijen, a Special Adviser on Energy to President Bola Tinubu, announced that Nigeria successfully attracted over $8 billion in investments related to deepwater projects and gas final investment decisions (FIDs) within a single year.

Gatekeepers News reports that this statement was made during the 2025 Africa CEO Forum held in Abidjan, Côte d’Ivoire.

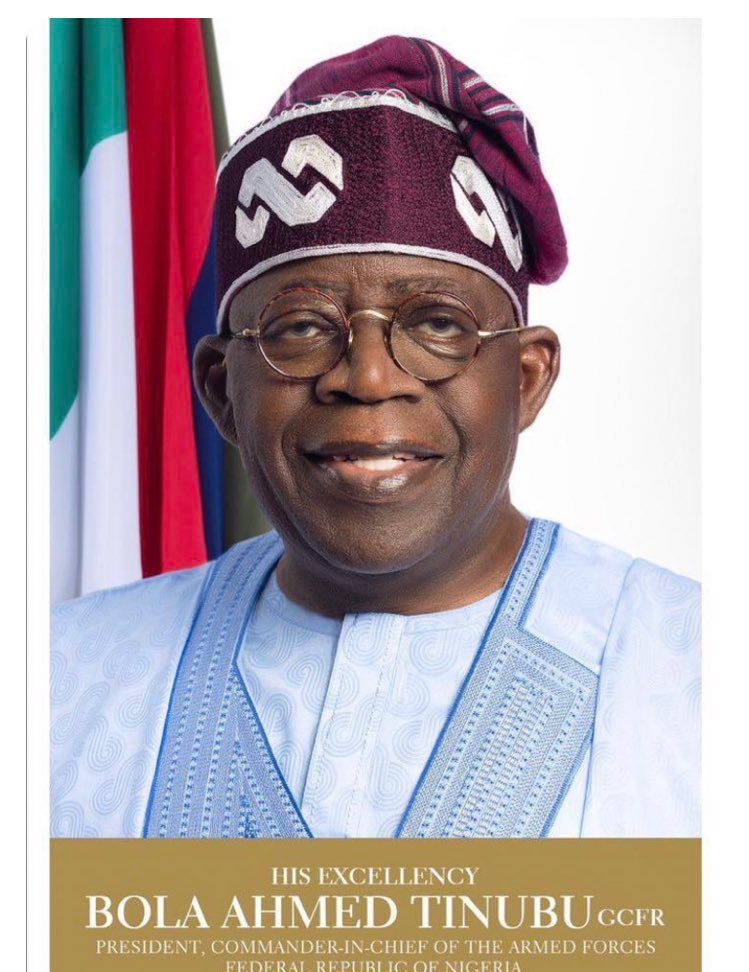

Verheijen attributed this significant achievement to the decisive actions taken by President Tinubu, which were aimed at enhancing the investment climate.

These actions, according to the News Agency of Nigeria (NAN) included improved fiscal terms, streamlined contracting timelines, clearer local content regulations, and reforms in the power sector that ensured the commercial viability of gas-to-power projects. She encouraged industry leaders throughout Africa to take inspiration from Nigeria’s success in attracting these investments.

The presidential aide urged them to ensure that Africa moves beyond appeals for support to becoming an investment destination by design, anchored in policy clarity, commercial logic, and strategic intent.

“Africa must partner smartly, not from dependency, but from aligned strategic interest,” she said.

“Nigeria has been able to prove that this approach works. We moved from gridlock to greenlight, and investors responded.

“Nigeria’s attainment of an increase in indigenous equity in gas, from 69 per cent to 83 per cent, is not just a statistic but a seismic shift in ownership and control of Africa’s energy future.”

Verheijen said African investors, development finance institutions (DFIs), banks, pension funds, and sovereigns must maintain strategic focus.

She urged them to strive to fill the vacuum left by international oil companies (IOCs) in terms of funding and with fit-for-purpose instruments and risk-sharing structures.

“Our sweet spot is onshore, shelf, and domestic gas. That’s where African players must dominate, because we understand the terrain, the risk, and the reward,” Verheijen said.

She also celebrated the feats of African private sector companies “like Seplat, Oando and Renaissance, who are no longer just “local players”.