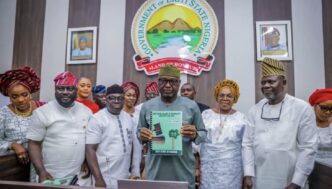

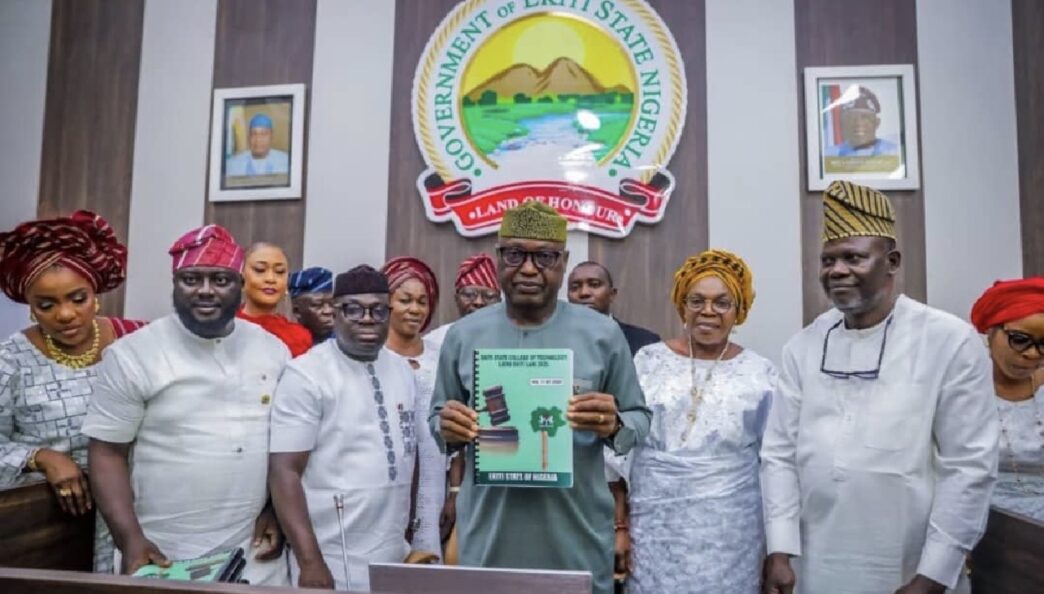

Ekiti State has become the first state to domesticate Nigeria Tax Administration Act after Governor Biodun Oyebanji signed Ekiti State Revenue Administration Law, 2025, into law.

Gakeepers News reports that the Governor assented to the law during a brief ceremony at the executive council chamber in Ado-Ekiti, where he also signed the state’s N415.57 billion 2026 budget.

Top government officials present included the deputy Governor, Monisade Afuye, Speaker of the Ekiti State House of Assembly, Adeoye Aribasoye, members of the legislature, executive council members, and revenue stakeholders.

Speaking at the event, Governor Oyebanji described the new revenue law as a major step towards transparency, accountability, and modern governance in the state’s revenue system.

He said the legislation fully aligns Ekiti with ongoing national tax reforms aimed at harmonising tax administration across the country.

He said, “From today, Ekiti adopts a strictly electronic payment, billing, and receipting system. This will eradicate leakages and ensure that your payments go directly into the state’s coffers.”

The Governor explained that the new law repeals the Ekiti State Board of Internal Revenue Law of 2019 and adopts the harmonised list of taxes and levies approved at the national level.

According to him, the reform will reduce multiple taxation, promote fairness, and improve the ease of doing business for individuals and organisations operating in the state.

Oyebanji added that the law gives the Ekiti State Internal Revenue Service full authority over revenue collection, provides for the accreditation of professional tax agents, and grants the service powers to enforce compliance, including prosecution and administrative penalties where necessary.

He noted that the changes are designed to strengthen internally generated revenue while protecting taxpayers from abuse.

The Governor also acknowledged the role of President Bola Tinubu, saying the federal government’s tax reforms created the framework that enabled states to modernise their revenue systems.

In his remarks, Segun Adesokan, executive secretary of the Joint Revenue Board, praised Ekiti for taking the lead in implementing the law.

He said the move fulfilled a resolution reached at the Joint Revenue Board retreat held in Ikogosi in September and described it as a strong signal of professionalism and commitment to tax autonomy at the state level.

He said, “Ekiti is the first state to domesticate the Nigeria Tax Administration Act, and this shows commitment to professionalism and autonomy in revenue administration.”

Adesokan expressed confidence that other states would soon follow Ekiti’s example as the federal government continues to push for uniform tax administration under President Tinubu’s fiscal reform agenda.

Governor Oyebanji also signed 2026 budget, tagged Budget of Sustainable Governance, stating that it focuses on completing ongoing projects, improving food security, expanding infrastructure, and driving wealth creation.

He disclosed that the budget allocates 53 percent to recurrent expenditure and 47 percent to capital expenditures.