Debt Management Office (DMO) has said the incoming government would inherit about N77 trillion debt from President Muhammadu Buhari’s administration ends in May.

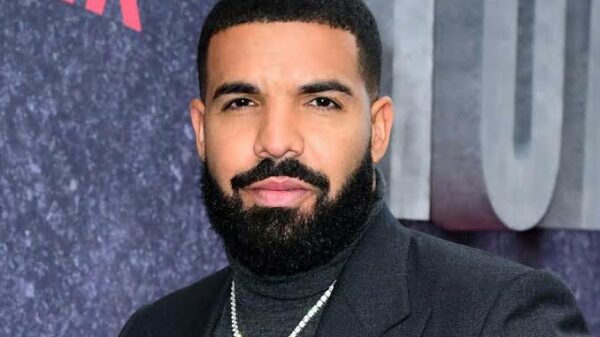

Gatekeepers News reports Director General, DMO, Patience Oniha said this while addressing journalists at the public presentation and breakdown of the highlights of the 2023 Appropriation Act in Abuja on Wednesday.

Buhari on Tuesday, signed the N21.83 trillion 2023 budget into law, with a deficit of N11.34 trillion.

The deficit represents 5.03 percent of the country’s Gross Domestic Product (GDP).

Minister of Finance, Budget, and National Planning, Zainab Ahmed had said the federal government would finance the deficit by borrowing.

On how the N11.34 trillion 2023 budget deficit will be funded, Ahmed said 22 percent of projected revenues will come from oil-related sources while 78 percent will be earned from non-oil sources.

According to her, N7.04 trillion would be borrowed from domestic sources, N1.76 trillion from foreign sources, and N1.77 billion from multilateral and bilateral loan drawdowns, while privatisation proceeds would provide N206.18 billion.

The federal government had earlier borrowed N6.3 trillion from the Central Bank of Nigeria (CBN) in the first 10 months of 2022 through ways and means.

Ways and Means is a loan facility through which the CBN finances the government’s budget shortfalls.

In October 2022, the federal government said it will repay the N20 trillion debt owed to the Central Bank of Nigeria (CBN) with securities such as treasury bills and bonds issuance.

However, the DMO boss, while speaking at the budget presentation, explained that the move by the federal government to securitise the loans (ways and means) from the central bank would drive up the debt to about N77 trillion.

Although data released by the DMO had put Nigeria’s public debt at N44.06 trillion as of the third quarter of 2022, the federal government plans to borrow more to finance both the supplementary and 2023 budgets.

Oniha said, “There are a lot of discussions on the ways and means. In addition to the significant cost saving in loan service we would get by securitising it, there is an element of transparency in the sense that it is now reflected in the public debt stock.

“Once it is passed by the national assembly, it means we will be seeing that figure included in the public debt. You will see a significant increase in public debt to N77 trillion.

“The other area of the debt stock we are trying to highlight is to say the debt stock is also growing from the issuance of promissory notes, which are not true borrowing as such by the government.“