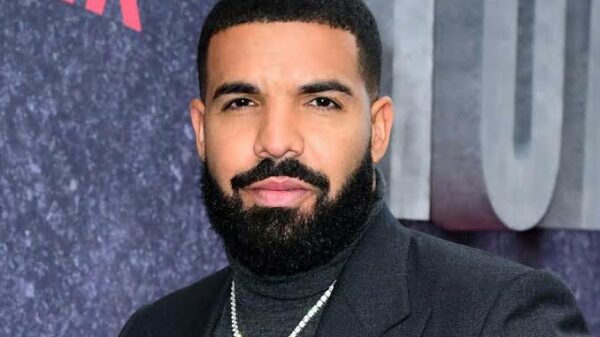

Pandora Papers investigation has revealed how the Acting Managing Director of Nigerian Ports Authority, Mohammed Bello-Koko, is involved in offshore dealings.

Gatekeepers News reports that the Pandora Papers investigation has revealed how Acting Managing Director of Nigerian Ports Authority, Mohammed Bello-Koko, is involved in offshore dealings, hiding behind two shell companies incorporated in a tax and secrecy haven to invest in the United Kingdom property market anonymously.

The revelations came from Pandora Papers, a trove of 11.9 million leaked confidential records obtained by the International Consortium of Investigative Journalists, ICIJ.

The ICIJ then coordinated a team of 617 journalists from 150 news outlets, including PREMIUM TIMES, to dive into the data.

The reporters spent two years sifting through the leaked records, tracking down sources, and digging into court files and other public records from dozens of countries. It is the most extensive collaboration of investigative journalists – from 117 countries and territories – in history.

The leaked records came from 14 offshore services firms from around the world that set up shell companies and other offshore nooks for clients like Bello-Koko, who seek to shroud their financial activities, often suspicious, in secrecy.

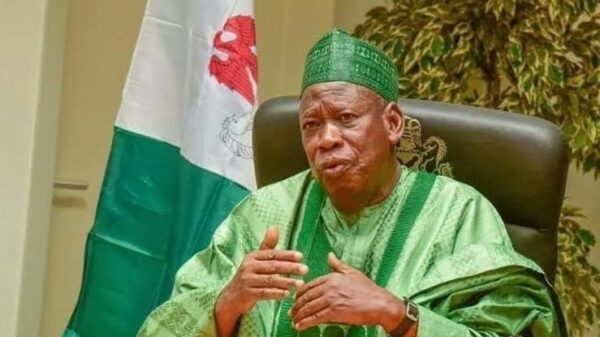

Bello-Koko is possibly hoping to be confirmed as the substantive NPA chief by President Muhammadu Buhari since the current substantive head of the agency, Hadiza Bala-Usman remains on suspension.

Bello-Koko, with his wife, Agatha Anne Koko, enlisted the services of financial secrecy seller, Cook Worldwide and Alemán, Cordero, Galindo & Lee (Alcogal), an offshore law firm, to register Coulwood Limited (reg. number: 1487897) and Marney Limited (reg. number: 1487944) in the British Virgin Islands (BVI), one of the world’s most commonly used tax havens, in 2008. Both companies were registered the same day, June 19, 2008.

Bello-Koko remains a director of the two companies even as a public servant in violation of Nigeria’s Code of Conduct Bureau and Tribunal Act (Sections 5 and 6). The regulators in the BVI also had his companies under watch for suspected money laundering; a problem Alcogal appeared to have helped him avoid with some misinformation provided to the regulators.

Bello-Koko is a former banker responsible for managing accounts of energy firms at the defunct FSB International Bank and later Zenith Bank, where he managed Rivers States government accounts in Nigeria’s oil-abundant Niger Delta region.

Although shell companies have been a key feature in illicit financial flow and are used to facilitate drug deals and terrorism financing, owning one is not necessarily illegal and can be for legitimate purposes.

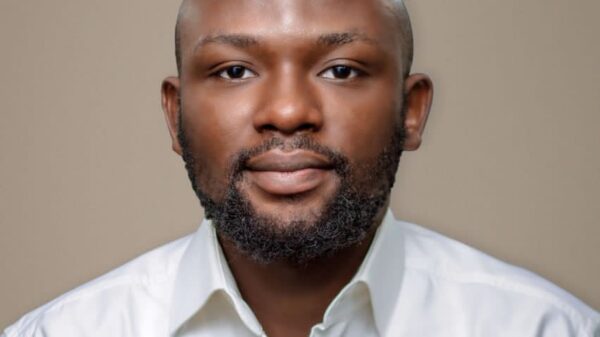

Bello-Koko was introduced to Cook Worldwide by Yemi Edun, the British-Nigerian behind Daniel Ford. He has helped several other Nigerians, including politically exposed persons, PEPs, to facilitate the creation of shell companies which are in turn used to invest in the UK property market secretly.

Some Nigerian-linked shell companies facilitated by Daniel Ford, a London property firm, were also used to own other London properties, PREMIUM TIMES investigation showed.

The Premium Times reported the properties that, “Bello-Koko first used Marney Limited to acquire Flat 2, Liberty Court, 141, Great North Way, London NW4 1PR with an FBN UK mortgage, on October 20, 2009, and, then on July 23, 2012, 62, Manton Road, Enfield, London EN3 6XZ mortgage-free (with cash). Both properties cost 275,000 pounds and 280,000 pounds, respectively, when they were acquired.

“Using the second company, Coulwood Limited, Mr Bello-Koko also bought three other London properties, namely 62 Corner Mead, Hendon, (NW9 5RD) on November 25, 2008; 37 Redlands Road, Enfield (EN3 5HN) on August 16, 2011; and 14, Faraday House, Aurora Gardens, London (SW11 8ED) on May 3, 2017.

“He paid 205,000 pounds for the 2011 Enfield property and 235,000 pounds for the 2008 Hendon property, which he sold, according to records, in May 2017 for 350,000 pounds.

“For the third, the 2017 Aurora Garden property, he paid 475,000 pounds, being his largest single investment in the UK property market. This was acquired after his NPA appointment.

“Analysis of the investments shows that between 2008 and 2012, four years before Mr Bello-Koko joined the NPA, he had spent on four London properties a sum of 995,000 pounds, an equivalent of 293 million Naira at the 2015 exchange rate of 294 Naira to a pound.

“The reason Mr Bello-Koko did not acquire the London assets in his name instead of hiding behind shell companies is unknown.

“His sources of funds for the investments are also not known. He did not reply to written questions emailed to him weeks ahead of this publication.”

Bello-Koko’s Marney Limited and Coulwood Limited were among nine companies placed under watch by the Financial Investigation Agency (FIA), the regulator in the British Virgin Islands. On January 20, 2017, FIA sought information about the affected companies, owned by Nigerians, Panamanians, and Russians from their registered agent, Alcogal, documents showed.

On January 27, 2017, the pieces of information requested by FIA, including identities of the beneficial owners, directors, and shareholders with their passports and permanent residence information, were sent via a letter signed by Alcogal’s money laundering reporting officer, Blondell Challenger.

Of all the nine companies, only Marney and Couldwood have the same persons – Mr Bello-Koko and his wife Agatha – as directors, shareholders, and ultimate beneficial owners, Alcogal told FIA.

Alcogal then told FIA that the nine companies “do not have any bank accounts or assets held in their name.” But this claim is contradicted by our findings – and at least for Mr Bello-Koko’s Marney and Coulwood, Alcogal only misled the FIA. As we found from UK Land Registry, Mr Bello-Koko and his wife own four London properties at the time of the correspondence in January 2017, and the fifth was added in May of that year.

In the correspondence, Alcogal indicated that they had requested “updated due diligence documentation” from the clients and that they would seize to be a registered agent of any of the clients that did not comply.

In May 2017, he bought his fifth anonymous London property.

A document suggests that Alcogal leaked information to Mr Bello-Koko that his companies were under investigation for money laundering. Then Alcogal itself came under investigation by the FIA for the leak.

We saw an Alcogal spreadsheet called “Registry of Inquiries – Financial Investigation Agency Control BVI -FIA 2017.” Regarding Mr Bello-Koko’s Marney Limited and Coulwood Limited, and six other companies, the sheet recorded the nature of the FIA’s inquiry as a “tipping off the offence.”

In the offshore industry, tipping off is a criminal offence committed when a person knows or suspects that a money-laundering investigation is being conducted into a client and leaks information to the client or someone close to them.